How Great Founders Stay Confident — Without Becoming Delusional

A mental framework to keep belief powerful, not poisonous.

The Psychology of Belief

When you’re standing at the starting line of a venture - product untested, market unproven, maybe you’re still doubting the business model, you have two choices: freeze in doubt or leap in belief. For founders, belief isn’t optional. It’s the fuel that lifts the business off the ground.

Why founders must believe

Early-stage entrepreneurship is a crucible of uncertainty. When you don’t know what the customer will actually pay, whether the team can deliver, or how competitors will respond - you’re navigating in fog. In that situation, belief is what moves you forward. It powers your pitch to investors, it galvanizes the team, and it drives you to keep going when the metrics aren’t yet comforting.

Put simply: without confidence, you stall. Vision remains untold. Products stay unlaunched. The founder who doesn’t believe doesn’t build—they wait.

Belief is not just nice to have - it becomes a strategic necessity.

The research: When belief becomes a psychological trait

But this isn’t just inspirational mumbo-jumbo. There’s a growing body of research showing that entrepreneurs are different when it comes to confidence, optimism and the way they interpret risk.

A study of overconfidence and optimism found that overconfidence correlates with the intention to become an entrepreneur.

Research distinguishes optimism (underestimating difficulty) from overconfidence (overestimating ability) — in entrepreneurs these biases often co-exist.

For example, the “Optimism Bias” is defined as our tendency to over-estimate positive events and under-estimate negative ones. (source)

Another piece of work shows entrepreneurs tend to discount external information and lean on their own judgment when overconfident.

In short, belief is embedded -psychologically and cognitively, in the founder’s mindset. And that can be a strength.

The upside of belief

Because belief functions as fuel, it brings clear advantages.

It helps you recruit. People follow conviction. A founder who says “I know we can do this” gets buy-in, even while metrics are still soft.

It fosters resilience. In the early days, you’ll hit walls; belief helps you persist through them when others might quit.

It enables bold moves. Visionary founders often take leaps that calculators wouldn’t sign off on—but those leaps are sometimes the differentiator.

Research confirms this: optimism supports creative solutions, idea generation, and the decision to launch a venture.

Why belief is almost built-in

Think about it: if everything in the startup world were predictable, you wouldn’t need a founder - you’d need a manager. Founders thrive when the odds are long, the variables messy. In that terrain, a rational, conservative mindset may leave you frozen while someone else leaps.

If you enjoy Founder’s Psyche, you’ll love FundEnable — my new newsletter on the art and science of startup fundraising.

From an evolutionary or behavioural standpoint, some studies argue that over-confidence thereby offers an adaptive edge in contexts of high uncertainty.

Moreover, in startup ecosystems, confidence becomes a form of social signalling. Investors, team members, early customers—often buy into the person as much as the idea. The founder who radiates certainty gets a little extra margin of trust.

Contents:

The Psychology of Belief

When Confidence Turns Toxic

The Founder’s Calibration System

Testing Your Conviction

Conclusion — The Paradox as a Discipline

Key Takeaways

When Confidence Turns Toxic

You once believed. You once searched for that impossible inflection. You once embraced the notion of being the founder who makes it happen. But somewhere along the way, confidence stopped being your ally; and quietly became your liability.

The subtle shift

In the early days of a venture, confidence feels like momentum. You’re shipping, you’re learning, you’re proving things. But as you scale, as the noise multiplies, the questions become harder and the gaps from assumption to reality widen. That’s when the line between grounded conviction and delusional assurance starts to blur.

What begins as “We’re going to take this on” can mutate into “We must win at all cost - because I know we will.” And when that mutation happens, your assumptions harden, feedback becomes a nuisance, and dissent turns into disloyalty.

Red-flags: When belief stops serving you

Here are some common indicators that confidence is tipping into toxicity:

You ignore or dismiss clear data that undermines your narrative. You interpret silence as “they just don’t understand” rather than “we might be wrong.”

You assume the hero role. The mindset becomes: I alone will save this. I alone understand it. The team becomes an accessory, not a partnership.

You keep doubling down — hiring, spending, pivoting the narrative — even though the foundational evidence isn’t improving.

You resist feedback or surround yourself with affirmers rather than dissenters. The phrase “we tried that already” masks the real question: “Did we really try it with an open mind?”

The culture starts reflecting your belief, not the metrics. Analytics become filters to justify action rather than inputs to inform it.

Research supports these signs. One meta-analysis found that while overconfidence is common among entrepreneurs, the negative effects tend to show up particularly in the post-launch phase - when assumptions accumulate and the founder thinks the pattern has broken forever.

Academic work also shows that overconfidence often means entrepreneurs overestimate their own skills and underestimate the complexity of what lies ahead.

Why it matters (and what it costs)

This is no mere academic concern. The cost of unchecked confidence is real and high:

Strategic drift: You may double down on the wrong bet simply because you believe you can catch up if you move fast enough.

Team erosion: People quit. Not because the idea was weak, but because they stopped being listened to. One VC-commentator pointed out: “A great idea fails fast with a toxic or rigid founder.”

Delayed pivots (or none at all): When you’re certain, you don’t pivot — you rationalise. And markets don’t wait.

Brand/market risk: The founder’s narrative starts to diverge from reality; investors smell misalignment; customers sense over-promising. According to one article: “Toxic founders and CEOs can hurt corporate reputations… booting them may help — but also may hurt the authenticity of the brand.”

In this sense, confidence without calibration is like high-performance fuel in a car with faulty brakes — you may go fast, but your risk of crash increases.

The psychological mechanics: Why founders fall into the trap

Optimism bias: Founders often underestimate the probability of negative outcomes. (Source)

Overconfidence / overprecision: They believe they know more than they do, or assume their predictions are more accurate than they in fact are. In one study of entrepreneurs in Austria, over-precision (thinking you’re that certain) was confirmed as a bias.

Feedback avoidance: When you build a narrative of inevitable success, admitting you’re wrong feels like cheating on your identity (“I’m the founder who always knows”). One paper explores why some entrepreneurs fail to learn from frequent market feedback.

Hero/identity distortion: Your identity as “the founder” becomes bound up with being right. So you avoid being wrong. This turns you from learner to preacher.

Escalation of commitment: Once you’ve publicly declared your vision loudly, changing direction is not just a strategy decision—it feels like defeat.

Real-world glimpses

While I won’t name names here (unless we turn to public, well-documented cases), you’ve almost certainly seen the pattern. Early wins—yet failure to adapt. A leader revered for raw conviction—yet unable to heed warning signs. A culture of unquestioning loyalty—yet no one outside the inner circle dares to say: “Boss, maybe we’re wrong about this.”

As one article puts it: “Such environments can become toxic… what once was decisive leadership starts to look like stubbornness.”

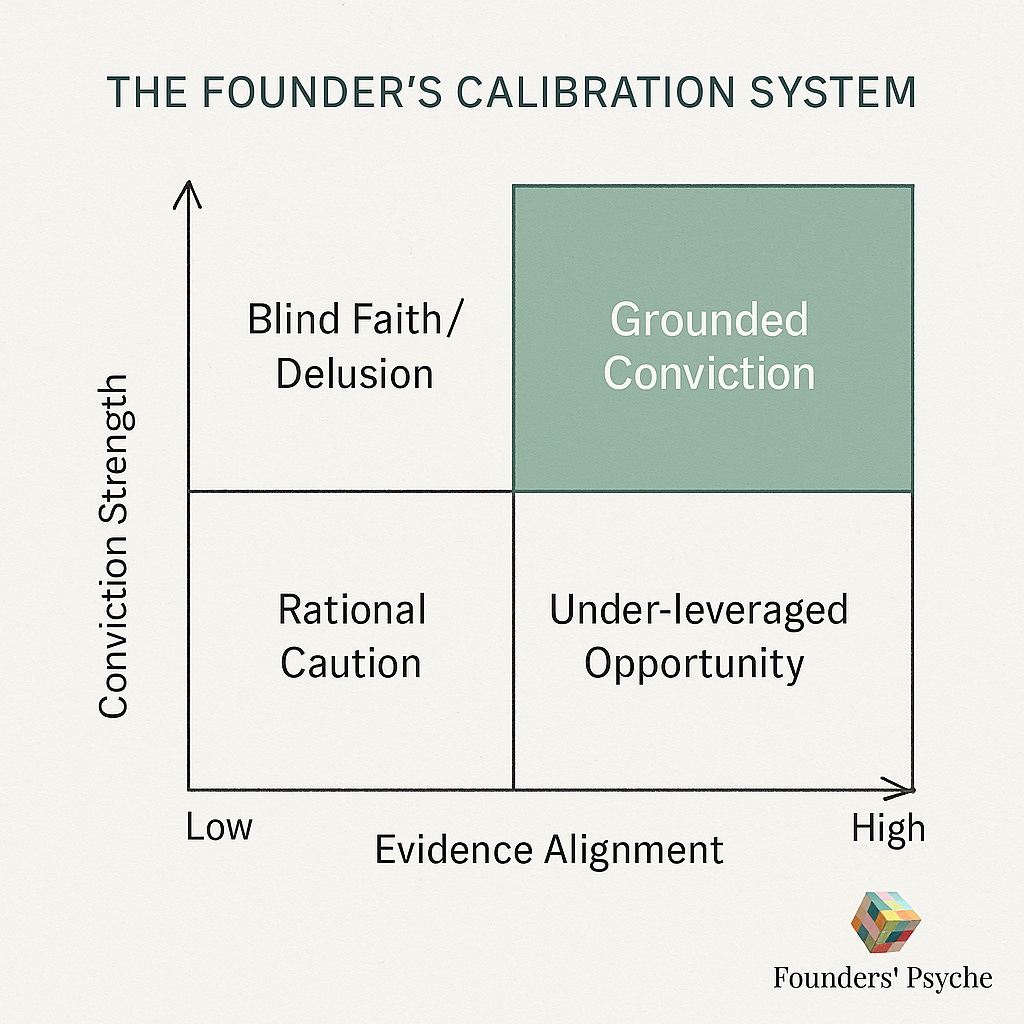

The Founder’s Calibration System

When confidence can push you forward, and delusion can pull you under, the key isn’t to eliminate belief - it’s to calibrate it. What follows is a practical system to help you check where you are, and steer toward the “grounded conviction” zone.

Picture this: a simple two-axis chart that helps you quickly locate your current mindset and actions.

X-axis: Evidence alignment — from low to high.

Y-axis: Conviction strength — from low to high.

This gives four quadrants:

High evidence + high conviction → Grounded Conviction (ideal)

Low evidence + high conviction → Blind Faith / Delusion (danger)

High evidence + low conviction → Under-leveraged Opportunity (safe, but weak)

Low evidence + low conviction → Rational Caution (safe, but low upside)

Here’s how to read them:

If you’re in the upper right - you’re both confident and supported by evidence. Green zone.

If you’re in the upper left - you’re very confident, but lack evidence. That’s the slippery slope toward delusion.

Lower right - you have evidence, but you’re holding back. You might be missing the bold moves you should be making.

Lower left - you’re cautious, maybe rightly so, but you’re not generating momentum.

What each quadrant looks like in action

Grounded Conviction: You’ve got market feedback, early traction, customer love, team alignment - and you still believe you can win. You act decisively, but you’re also open to being wrong.

Blind Faith/Delusion: You believe fiercely, but the signal-to-noise is weak. You ignore bad data, rationalise away friction, maybe recruit folks who just echo your view.

Under-leveraged Opportunity: Everything is looking decent - good feedback loops, early wins, but you hesitate. You’re cautious, risk-averse, maybe waiting for “perfect” proof.

Rational Caution: You have neither strong conviction nor strong evidence. Perhaps you’re playing it safe; maybe it’s the right call in some contexts, but growth is unlikely.

How to use the matrix (and when)

Self-assessment: Pause and ask yourself: Which quadrant am I in right now?

Time-series: Revisit the matrix regularly (monthly/quarterly). Are you moving toward grounded conviction? Or drifting toward blind faith?

Board/advisor check-in: At your next board/leadership meeting, bring this: “What evidence do we have? What conviction do we hold? Are they aligned?”

Diagnostics: Use calibrated questions (see next sub-section) to validate your quadrant.

Instrument prompts: Questions to ask yourself

When was the last time I changed my mind? What triggered it?

What data do we have that contradicts our belief? Did I invite it or ignore it?

How comfortable am I being wrong? What is our plan-B?

Are we building to succeed, or are we trying to avoid failure?

If the market told us “no” tomorrow, would we hear it or dismiss it as “they don’t get us”?

Integrating feedback loops and culture

Calibration isn’t just a mental exercise — it becomes part of your operating system.

Feedback rituals: Monthly “Reality Check Loop” meetings: review assumptions vs actuals; highlight where things diverged.

Pre-mortem sessions: Quarterly, imagine your venture failed in 12 months; ask why. Reverse-engineer from that failure.

Devil’s-advocate role: Assign someone (or rotate) to challenge core assumptions, not to be negative, but to surface blind spots.

Cultural reinforcement: Value the phrase “What am I missing?” as much as “Here’s the plan.” Encourage dissent and data-driven pivoting.

Why it matters — the payoff

By turning calibration into a discipline, you avoid two traps:

Over-extend too soon (trusting belief without proof)

Under-invest too late (having proof but lacking belief)

Instead, you remain in the sweet spot: bold yet grounded. This leads to better decisions, stronger team alignment, earlier recognition of pivots, and ultimately a higher probability of scaling.

Testing Your Conviction

If Sections 1 and 2 laid out the how and why of the paradox — belief vs. delusion — and Section 3 provided the calibration framework, this section is your hands-on checklist: how to test your conviction, how to build habits that keep you grounded, and how to turn this into a leadership discipline.

Self-Diagnostic Checklist

To start, you need a mirror. These are questions every founder should ask themselves (and answer honestly) on a regular rhythm (monthly or quarterly):

When was the last time I changed my mind about a core assumption? How did that go?

What data do we have that contradicts our belief? Have I invited that data - or ignored it?

Am I comfortable being wrong? Do we have a clear Plan B?

Are we building to succeed, or are we trying to avoid failure?

If the market told us “no” tomorrow - would we hear it… or would we rationalise it as “they don’t understand yet”?

This self-auditing is critical because it keeps you honest. Over time you’ll see patterns: when you always answer “I haven’t changed my mind recently”, you may be tipping into the “delusional” quadrant of our matrix.

Routine Practices & Habits

Here are concrete routines you can embed into your leadership rhythm to keep conviction healthy and aligned with reality:

Monthly “Reality-Check Loop”

Review key assumptions vs actuals: what we expected, what happened.

Flag where things are diverging. Ask: Why?

Ask: What assumption might be wrong?

Quarterly “Pre-Mortem” Session

Organise a facilitated exercise: imagine the company failed in 12 months. Ask: Why did it fail?

Identify the highest-risk scenarios, then develop mitigation plans.

Research shows this method (originally from Gary Klein) increases a team’s ability to identify failure causes by ~30%.

Feedback Calendar & Devil’s Advocate Role

Schedule regular sessions where you seek dissent, not approval.

Assign someone (rotating) to play “what are we missing?” This role is not negativity but vigilance.

Behavioral Reinforcement

Encourage your team to ask: “What am I missing?” instead of “Here’s the plan.”

Celebrate the willingness to pivot as much as the willingness to execute.

Team & Board Actions

Conviction calibration isn’t just your job — it’s the leadership culture you foster.

At board meetings, lead with: “Here’s our conviction. Here’s the evidence. Here’s what might be wrong with that.”

Make data transparent: regularly show assumptions, actuals, divergences.

Build psychological safety: Make it safe for team members to say “I don’t know” or “I think we’re missing something.”

Reward learning over bravado: The founder who admits “I was wrong” is stronger than the founder who ignores misalignment.

Mindset Shift: Confidence Redefined

Remember: this isn’t about killing confidence. It’s about redefining it. True founder confidence is less about “I cannot fail” and more about “I believe we can adapt and learn.”

That means:

Being bold and being humble.

Holding conviction and holding questions.

Charging forward and leaving room to turn around if needed.

By treating conviction like a muscle you exercise, you avoid both extremes: paralysis (too little belief) and recklessness (too much belief without grounding).

Staying in that “grounded conviction” zone means you lead with both faith and facts.

Conclusion — The Paradox as a Discipline

Every founder eventually learns that confidence and delusion are not opposites — they are neighbors separated by a thin, shifting line.

On one side lies the belief that bends reality just enough to create something new. On the other lies the belief that bends it until it breaks.

The trick isn’t to eliminate belief.

It’s to discipline it.

When you practice disciplined belief, you still dream audaciously — but you measure what’s real. You listen to dissent before it turns into disaster. You push your team forward, but you also allow them to pull you back. You treat conviction not as armor, but as a muscle — one that needs tension, resistance, and regular calibration to stay strong.

That’s the real work of leadership.

Not just having confidence, but earning it - again and again - through evidence, reflection, and adaptability.

Because in startups, confidence without correction becomes delusion.

But confidence with correction becomes wisdom.

And founders who master that discipline don’t just survive longer — they evolve faster.

They out-learn the illusion.

Key Takeaways:

Belief is fuel, not proof. Confidence powers momentum — but it doesn’t replace evidence.

Overconfidence hides as optimism. The same conviction that drives you can quietly blind you.

Calibration beats charisma. Great founders align conviction with data, not ego.

Feedback is your safety net. The faster you invite correction, the longer your belief survives.

Confidence isn’t being sure — it’s staying curious. The best founders don’t defend their ideas; they evolve them.

Best,

Ashish